Sunday, 10 March 2013

Friday, 8 March 2013

Quiet Days are the Second Hardest

TL;DR: Over the past year, I’ve been trying to increase the routine and rhythm in my day for one primary reason – increase and improve creative energy. Essentially, reduce my daily cognitive load for daily tasks thereby increasing the chances of ‘shower thinking’ throughout the day.

Everyday, immediately after I step out of the shower, I floss my teeth. Perhaps it’s not the most logical place in the day for dental hygene. But this is the place in my day where it stuck. For the past six months reaching for the floss at that point in my day has become so natural and routine that I’ve been able to build another behavior atop it – cleaning my glasses. With these small changes in my routine established, I’ve decided to implement some additional changes elsewhere in my day.

The first – wake up before 6:30am each day. As you might expect, this is significantly easier if you retire earlier. I’m sure that’s quite obvious to you. It was a small epiphany to me. Waking up earlier (usually between 5:30 and 6am depending on my Zeo) has reminded me how much I enjoy sunrises. The slowly brightening glow of morning – the chirp of the birds. Even in winter. Arising earlier has also confirmed that I’m a better father once I’ve had an hour to prepare myself for the day. Rather feeling the days have jerky, jarring stops and starts – my days now flow together. I know decisions I make in the evening have a direct impact my morning. Every minute past 10pm means another minute past 6am. Every minute past 6am is another minute I don’t have before the kids want breakfast. Means another minute I don’t have for preparing myself for the day.

Since last October, preparing myself for the day has meant Morning Pages. Three handwritten pages, stream of conscious. Each page takes about 15 minutes. Timed right, the morning sun starts to come through the kitchen window about half way down the third page – the same point the themes in my writing start to come together. There are usually a couple of small To Dos lurking in those pages. Without Morning Pages, I’m sure they’d just haunt me. Instead, they’re completed immediately after putting the notebook away.

Right now, I’m in the midst of training for the Get In Gear Half Marathon. Now, every other day commit to a short (3-5 mile) run before starting any client work. I tried evening runs and afternoon runs. Morning runs have been the most successful. By a long shot.

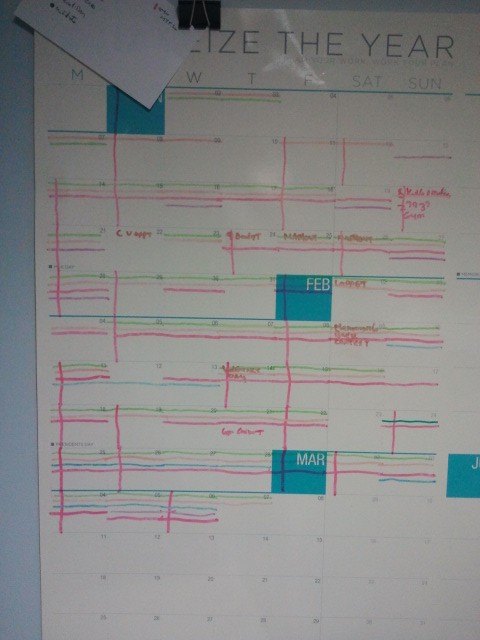

To track all this I picked up a giant all year calendar from NeuYear.net and a handful of thin whiteboard markers.

Then I went at it all Giles Bowkett-style.

All habits that are yet to stabilize are up there. The index card clipped to the top declares 8 habits and 8 colors. Lines marked across days I complete them.

Things that have been easy to instill that I’m still tracking:

- going to be earlier

- waking up earlier

- writing morning pages

- inbox zero (yes, suprisingly easy sustain inbox zero. More on that later)

“Quiet Days” – defined as not ever, never, directing attention to audio or video media created by someone else. It’s one of the more difficult challenges. Hell, I haven’t marked it off once yet – that’s how difficult I’m finding it. My theory is that every time I turn on the radio (or Pandora, or watch a TED video, or or or or) I’m choosing to not let my ‘shower brain’ offer a clever solution to a problem it’s been working on. Small meditations while driving are amazingly helpful, and so much more peaceful than the fall of civilization presented on broadcast radio. The challenge is in breaking my long-term habit of listening to punk rock and drum-n-bass while working on my hardest problems. The music hurts as much as it once helped. Once I get the first success, I’ll know how to get the second and the third. Yet, even without having a single day crossed off, “Quiet Days” are still the second hardest.

The hardest habit is writing daily for the book project. The mark is 1000 words a day. A humble goal. There are very few marks on the calendar. Fewer than a dozen across 10 weeks. That’s not progress. Writers know this. This isn’t news. Writing is hard work. This is exactly why I’m building routines into my day. The book project is why I’m changing everything else around my. To increase the creative energy I can commit to writing.

Late last year, I read ‘The Power of Full Engagment’, I’ve probably mentioned it to you in a very impassioned tone. It’s good. Here’s what I took away from it: “you’re probably spending your creative energies on things you can do without thinking. Work those things into a routine – and you’ll have the creative energies to do meaningful work.”

The promise is so compelling. Results?

While it’s only 10 weeks into the new year, I’m seeing significant increases in my creative energies. I’m procrastinating far less, I’m feeling more calm, and I’ve sketched out some fresh ideas for projects that have been collecting dust for years. It feels good to move those project forward. And I’m starting to sense the early stages of new projects, new directions, new challenges. Ones that I knew I wouldn’t have noticed with all the cognitive load of determining when I should floss my teeth or clean my glasses.

There. One thousand words.

Thursday, 7 March 2013

Best Buy Should Partner with Jiffy Lube Next

My last engagement with Best Buy concluded 4 years ago – and even then it was an organization under a radical transformation. These challenges have only increased in the past year. Additionally, many of digital savvy members of Best Buy’s leadership have left. Yet, I’m still quite optimistic for BBY’s future. I still think Best Buy has a unique opportunity to be an inspiring, forward-looking company – much as Microsoft and Google.

The most interesting move in this direction is the partnership between Best Buy and Target – where Best Buy’s Geek Squad staff Target’s electronics desk. They’ll be at 29 Targets – including the one down the street from me (curiously – not T1). This is a chocolate-in-my-peanut-butter partnership that makes you wonder what it didn’t happen sooner. For Best Buy – it exposes the GeekSquad brand and core expertise to a broader customer-base in a venue not know for it’s electronics expertise. Huge win.

Additionally, two other smaller, focused Best Buy stores seem very interesting. The first is the Best Buy Express kiosks in airports and malls (a partnership with Zoom Systems). All the most popular, in demand, portable electronics in a bookcase sized format. My last business trip, I picked up replacement noise-cancelling headphones from a BBY Express on my way to the gate. Easily my fondest Best Buy experience. The second is the Best Buy Mobile stores – focusing on primarily on mobile phones. In my neighborhood, there’s one just across the highway from a Best Buy big box stores. The smaller footprint and focus on portable devices makes them very attractive for strip malls with tight storefronts and likely foot traffic.

Best Buy has extended the Geek Squad brand, portable electronics segment, and mobile phone segment beyond the big box store. What’s next? What would be inspiring and forward looking?

In 1956, Frank Lloyd Wright built a gas station in Cloquet, MN. The architecture was based off his Broadacre City project – his vision of a modern urban landscape. Of the gas station he said:

“Watch the little gas station – In our present gasoline service station you may see a crude beginning to such important advance decentralization” – Frank Lloyd Wright

Today, our cars are mostly gasoline-powered mobile computers with wheels. Some of them are even electric mobile computers on wheels with gasoline backup. Whether it’s the electronics with the cars going on the fritz, the additional electronics we put in them not working right, or the two not talking to each other in the way we want our vehicles are now need computer support. Our GeekSquad needs have moved from the home office to the living room to our cars.

For years Best Buy has sold and installed car stereos. Though, it’s never felt like they really cared about that part of the store (same for home appliances). So, I say, send the car stereo section out into the world – just as they have with the GeekSquad and the portable electronics. Partner with someone that knows automotive, with a number of convenient, small footprint locations, and a well-known brand. Someone like JiffyLube. Use the partnership to promote the next generation of automobile technologies: self-driving cars, electric charging stations, natural gas refueling stations, replacement batteries, new interfaces between driver and machine, new passenger entertainment options, the next generation wayfinding systems.

Do something no one else can do – create a place that makes the future of the American car a reality.

Update 2 Apr 2013

Best Buy Co. and Target Corp. have ended their experimental Geek Squad partnership, the Star Tribune has confirmed. Blah. Thanks to MJK for the pointer.

[UPDATED] The Business-to-Business Sales Tax Discourages Investment in Minnesota

Update 8 March: Victory! – Dayton drop b2b sales tax proposal

This morning at the MHTA legislative action briefing, I heard many stories of Minnesota based companies planning out-of-state moves and employment changes ahead of Governor Dayton’s proposed business to business sales tax.

Here is the message I sent the Governor, my state senator, and my state representative.

“For the last 10 year my small business has helped Minnesota companies make strategic investments in innovative technologies. The B2B sales tax discourages my clients from engaging my services and therefore discourages investing in Minnesota’s future.”

I encourage you to send a similar message to your representatives.

Tuesday, 5 March 2013

Client Launches: ExperienceLife.com Now Responsive

From the official press release on my recent work with the ExperienceLife.com team

Also includes this quote from me:

“One of the most cost-effective ways for web publishers to make sure their sites offer real functionality no matter their users’ choice of platform or screen size is through responsive design.”

Yes, I actually just wrote this down for a high-level description of a new project.

Monday, 4 March 2013

Fine, I’ll admit that email is scheumorphic.

- ‘Forward’

- ‘CC’

- ‘BCC’

- ‘Signature’

All of these elements are carry-overs from, not only an archaic communication model, but an extremely bureaucratic one. One where high value is placed on traceability and formality. I suspect those two concepts by themselves result in higher communicatations costs, reduced message volume, and higher default priority.

Do we have a communication interface that reflects our current world? One where communication is casual, informal, cheap, and 99.9% of it is unwanted, unactionable, and otherwise unnecessary?

Email’s IMAP protocol could still support this, it’s the interface on the client side that requires the most significant updating.

And I don’t mean echoing the interoffice envelope.

Taking Stock

A continuous stream can so quickly turns into background static. Just turn on any radio station or cable news station for proof. So much inane, meaningless, chatter between overly dramatic transitions to maintain attention and distract people from taking stock.

Infrequency has the benefit of being a novelty. Additionally, from what I see in this new publishing world – there’s an inverse relationship between frequency of publishing and positive impact on reputation.

I predict that if these real-time marketing channels (tumblr, twitter, facebook, et al) stick around another 5 years we’ll see a thriving industry of part-time, entry-level people dealing with it. Hell, I predict that these hired hands will handle most internet interactions for their clients. The role somewhere between personal assistant and PR agency. Especially those clients who feel the potential disruption of their own psychological flow is too significant to risk.

Perhaps, this is even something true fans will do out of their love. This final scenario may be the only saving grace for social media as we know it.

P.S. Proving my point, I was just pointed to Robin’s post this morning and it’s more than 3 years old. Significance continues to trump timeliness.

Sunday, 3 March 2013

Adding by Substracting

I Started a To Do List for You

This comic sparked a Twitter conversation: “Do What You Love? A Debate.”