[In collaboration with Ivan Stegic]

“Context is that which is scarce” – Tyler Cowen

Product companies have an allegiance to the product.

Service companies have an allegiance to the customer.

Both are legitimate vows.

Both, unexamined, become traps.

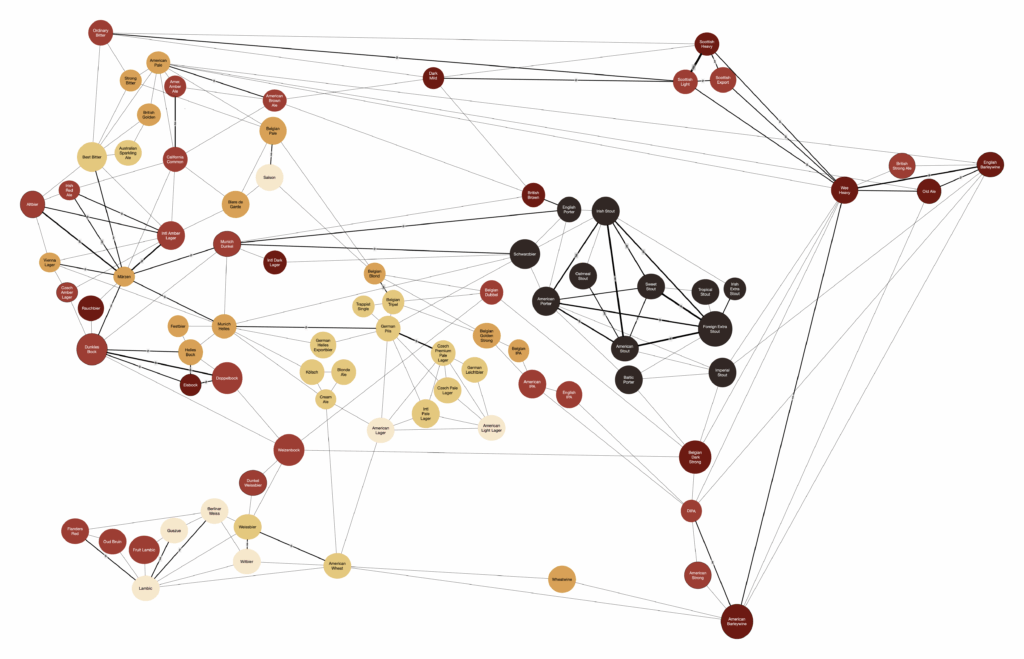

The coastline paradox — the more accurately you measure the coastline, the longer it grows — is the most precise metaphor for this trap.

The closer you get to matching your offering to your customer’s precise shape, the more shape there is to trace. It never bottoms out. Their coastline is infinite.

Too often product leaders are hesitant to even lower their elevation claiming ‘it doesn’t scale’ – despite the competitive advantage waiting in the details.

The customer faces the same question from the other side.

Before choosing a vendor, someone at the customer has to decide:

Do we want to invest our competitive advantage in this JobToBeDone?

- If yes – let’s get a tailored-fit solution to start and consider building out an internal team.

- If no, we’ll adapt to the undifferentiated product and focus time, energy, and budget elsewhere.

The customer who chooses a product company isn’t settling. They’re making a deliberate choice not to compete on CRM, project management, email clients, calendaring, document management, accounting, or hosting. The customer choosing a service company is betting a custom solution will serve them better. Both are allegiances to a strategic outcome for their organization.

Let’s imagine a customer’s organization as terrain as dramatic as mountainsides and fjords.

A product company operates at elevation, let’s call it satellite view; coastlines are visible, yet smallest inlets untraced. The higher the elevation, the more customers fit, but only in the most abstract manner. Despite the abstraction, the edges of the product are firm, which makes on-the-ground implementation awkward. Accommodations within the organization will need to be made and the pricing reflects the mismatch.

A service company descends, and gets closer to the customer’s actual shape from the beginning. The promise: we will tailor to you, as perfectly as your budget will support. Higher price, because every engagement, every organization is unique, and little can be repurposed elsewhere..

The trap isn’t in which model is chosen, it’s in unexamined drift away.

Product companies don’t decide to become service companies. They inadvertently drift there, one big logo at a time. First, the product gets built for one prestigious customer’s inlets. Eighteen months later it perfectly fits this one customer and everyone else with increasing awkwardness..The portfolio quietly churns.

Service companies fall into the mirror image. The stated allegiance is to the customer — but the actual allegiance, in practice, is to the ongoing relationship. They seem identical until the desired outcome is achieved. Then they diverge.

Allegiance to the relationship says: Stay, find more to do, trace more coastline.

Allegiance to the outcome says: You’re done. Leave.

Consultant: noun, someone who comes in to fix a problem but ends up becoming part of it.

The service company’s trap is confusing being needed with being effective.

There’s a third allegiance, and it’s the one worth keeping: allegiance to the outcome.

For the product company, it’s answering every anchor customer request with a simple question: Does this serve the outcome we promised the portfolio, or just this one?

For the service company, it holds the line against indefinite engagement. The practitioner who leaves when the work is done is being faithful to the outcome, not disloyal to the relationship.

Both take discipline.

The competitive advantage for a product company lives in controlled descent, going just a little deeper into the customers’ shape than the competitors; dedicated Customer Success, dedicated account executives, custom onboarding, custom implementation. Deliberately priced.

The danger is reactive descent, subletting office space from the customer.